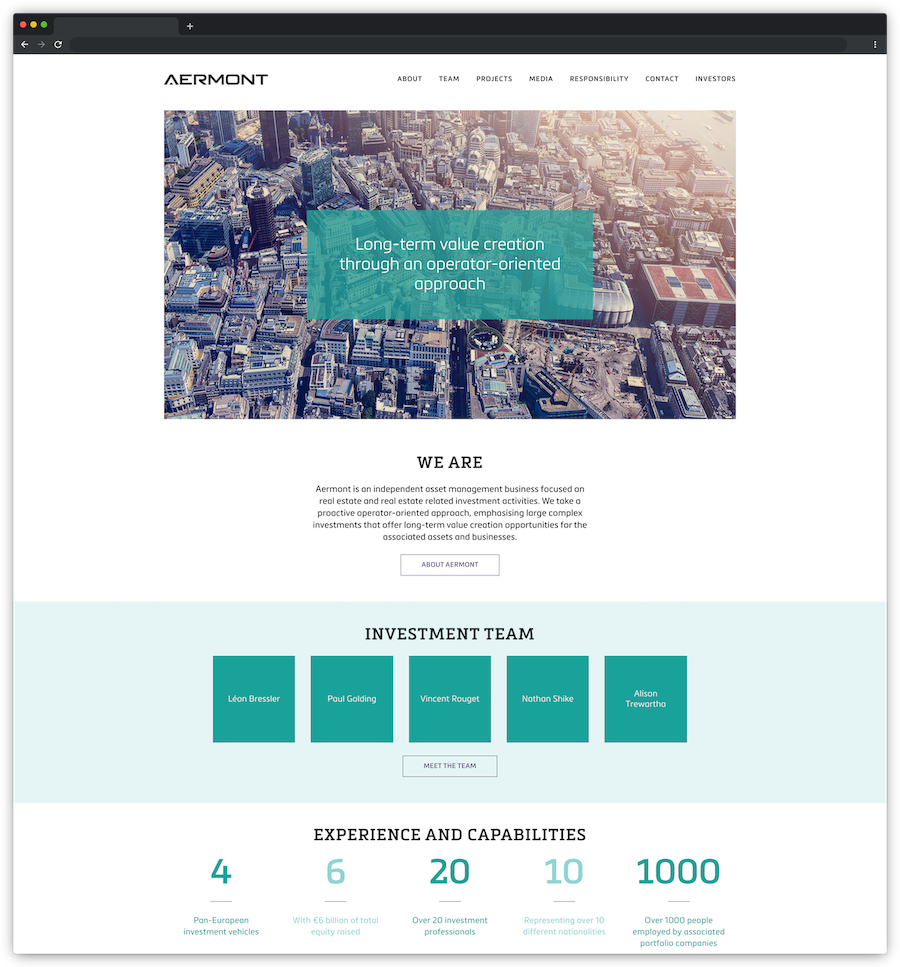

Aermont Capital

Read our in-depth profile of the European investment firm focused on Real Estate and managed by Leon BRESSLER

Aermont Capital is an independant European asset management firm that focuses on real estate and real estate related investment activities.

Table of contents

Aermont overview

Aermont employs a differentiated and opportunistic investment approach of acquiring property-rich platforms and real estate operating companies, as well as direct assets and real estate credit in Western Europe. Fund IV intends to continue Aermont Capital’s value-oriented investment approach focused on buying companies and assets at attractive valuations and driving returns through operational improvement. The Fund will focus on middle-market and large enterprise opportunities that are expected to require equity investments of between €75 million and €300 million. Aermont Capital is headquartered in London (England), with offices in Luxembourg, Paris (France). The Firm strategy is to execute opportunistic real estate investments across property types throughout Europe.

History

Formelly known as Perella Weinberg Real Estate (PWRE), the company was setup in 2007 as the Real Estate arm of Perella Weinberg Partners, a Private Equity firm. The company was spun-off from PWP in july 2015 by Leon BRESSLER who took full control. In 2016 PW Real Estate changed his name to Aermont Capital. Today the company is wholly owned by five partners :

- Léon Bressler (Managing Partner)

- Paul Golding,

- Vincent Rouget,

- Nathan Shike,

- Alison Trewartha.

Investments & track record

In 2018, Aermont Capital and BASSAC (a french real estate developer) acquired BPD Marignan, a french Real Estate development company formely owned by Bouwfonds, an international real estate company of RaboBank, a Dutch bank.

In 2021, Aermont Capital and Xavier NIEL started a consortium to overturn a capital increase of Unibail-Rodamco-Westfield, the french REIT specialised in commercial center and offices.

Milestoness

Competitors & similar Cos

Stam Europe, Patron Capital, Blackstone, Carlyle,

Affiliated companies

Aermont Capital Management S.à r.l.(Luxembourg),

Aermont Capital LLP (London, United-Kingdom),